lakewood sales tax filing

Taxpayers who wish to pay their quarterly estimated tax bills may do so using this service. We focus on facilitating appropriate real estate development and.

Tax Information And Resources Cleveland Public Library

There are a few ways to e-file sales tax returns.

. The local sales tax rate in Lakewood Illinois is 725 as of January 2022. License file and pay returns for your business. The County sales tax rate is.

Lakewood sales tax filing Monday February 14 2022 Edit Colorados state sales tax is the lowest in the country out of states with a sales tax but county and city taxes mean Coloradoans can end up paying more. Annual returns are due January 20. Published on April 29 2022.

File your state income taxes online. The City of Lakewood requires persons who expect to owe more than 20000 in tax for the current filing year to make quarterly estimated tax payments. The County sales tax rate is.

Learn more about transactions subject to Lakewood salesuse tax. What is the sales tax rate in Lakewood New Jersey. Returns can be accessed online at Lakewood.

800 AM to 430 PM. Lakewood City Hall. The outbreak of COVID-19 caused by the coronavirus may have impacted sales tax filing due dates in Lakewood.

Look up 2022 sales tax rates for Lakewood Tennessee and surrounding areas. Sales tax returns may be filed annually. The City of Lakewood receives 1 of the 100 sales tax rate.

Skip to main content. Skip to main content. Filing of Sales Tax Returns Sales tax returns and payments shall be made monthly before the twentieth 20th day of the following month.

Lakewoods approach to economic development is as unique as our community. Get information on Accommodations Business Occupation Motor Vehicle and Property taxes in Lakewood. Look up 2022 sales tax rates for Lakewood Pennsylvania and surrounding areas.

Sales and use tax returns are due on the 20th day of each month following the end of the filing period. This is the total of state county and city sales tax rates. The Lakewood sales tax rate is.

This is the total of state county and city sales tax rates. The Sales and Use Tax Return is generally due on the 20th of the month. The Finance Director may permit businesses whose monthly collected tax is less than three hundred dollars 300 to make returns and payments on a quarterly basis.

The New Jersey sales tax rate is currently. Re Taxes Small Business Tax Tax Time Business Tax Your Taxes Then And Now Visual Ly Infographic Infographic Design Finance Infographic Sales Use Tax City Of Lakewood Related. As part of the permitting process Contractor C pays a use tax.

Tax rates are provided by Avalara and updated monthly. Lakewood OH 44107 216 521-7580. Accounting budgeting financial reporting cash and debt management investments sales and use tax revenue collection utility billing purchasing shipping receiving and mailroom services and real property management.

Lakewood sales tax online filing Wednesday February 23 2022 Edit. 15 or less per month. Business B must report and pay a use tax of 05 on the purchase price which is the difference between the 3 Lakewood sales tax rate and that of Centennial.

The 8 sales tax rate in Lakewood consists of 4 New York state sales tax and 4 Chautauqua County sales taxThere is no applicable city tax or special tax. Filing frequency is determined by the amount of sales tax collected monthly. The Lakewood sales tax rate is.

Business Licensing Tax. The breakdown of the 100 sales tax rate is as follows. Sales tax returns may be filed quarterly.

Contractor C applies for a building permit for a remodeling job valued at 7000. Taxpayers may also check estimates file their current years tax return and upload digital copies of their tax documents such as W-2s or Federal 1040 for both the current year and prior years. Did South Dakota v.

Please consult your local tax authority for specific details. The minimum combined 2022 sales tax rate for Lakewood Colorado is. The Finance Department performs all financial functions for the City of Lakewood.

Under 300 per month. The Lakewood Colorado sales tax is 750 consisting of 290 Colorado state sales tax and 460 Lakewood local sales taxesThe local sales tax consists of a 050 county sales tax a 300 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. Scavenger hunt highlights Historic Preservation Month.

Please consult your local tax authority for specific. Galaxy auto sales arlington. Tax rates are provided by Avalara and updated monthly.

Collects Centennial sales tax of 25. The Colorado sales tax rate is currently. The minimum combined 2022 sales tax rate for Lakewood New Jersey is.

Learn more about sales and use tax public improvement fees and find resources and publications. Tax rates are provided by Avalara and updated monthly. The ST3 sales and use tax rate of 050 is effective April 1 2017 bringing the total sales and use tax rate for Sound Transit to 140.

License file and pay returns for your business. Learn more about sales and use tax public improvement fees and find resources and publications. The outbreak of COVID-19 caused by the coronavirus may have impacted sales tax filing due dates in Lakewood.

Lakewoods Historic Preservation Commission invites all residents to join a self-guided scavenger hunt virtually or in person during May to search for unique architectural elements and historic structures found at OKane and Washington Heights parks. Estimates for the current year are billed quarterly with the exception of the first quarterwhich is due to be paid with your tax return by the April filing deadline. Look up 2022 sales tax rates for Lakewood Washington and surrounding areas.

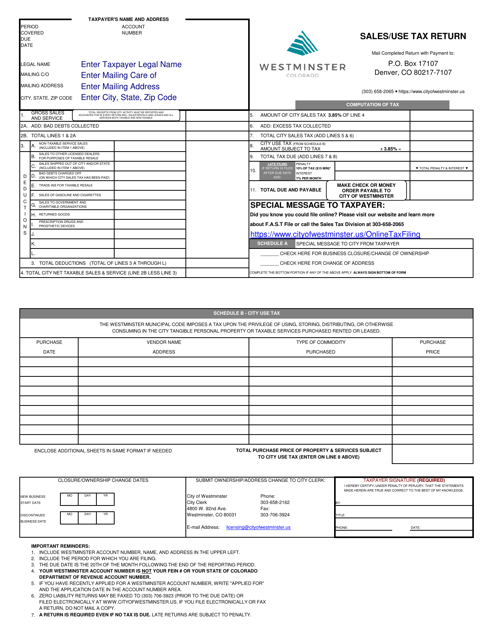

City Of Westminster Colorado Sales Use Tax Return Download Fillable Pdf Templateroller

Ways To File Taxes For Free With H R Block H R Block Newsroom

File Sales Tax Online Department Of Revenue Taxation

Sales Use Tax City Of Lakewood

File Sales Tax Online Department Of Revenue Taxation

The Smarter Way To File Your Taxes Infographic Filing Taxes Tax Refund Infographic

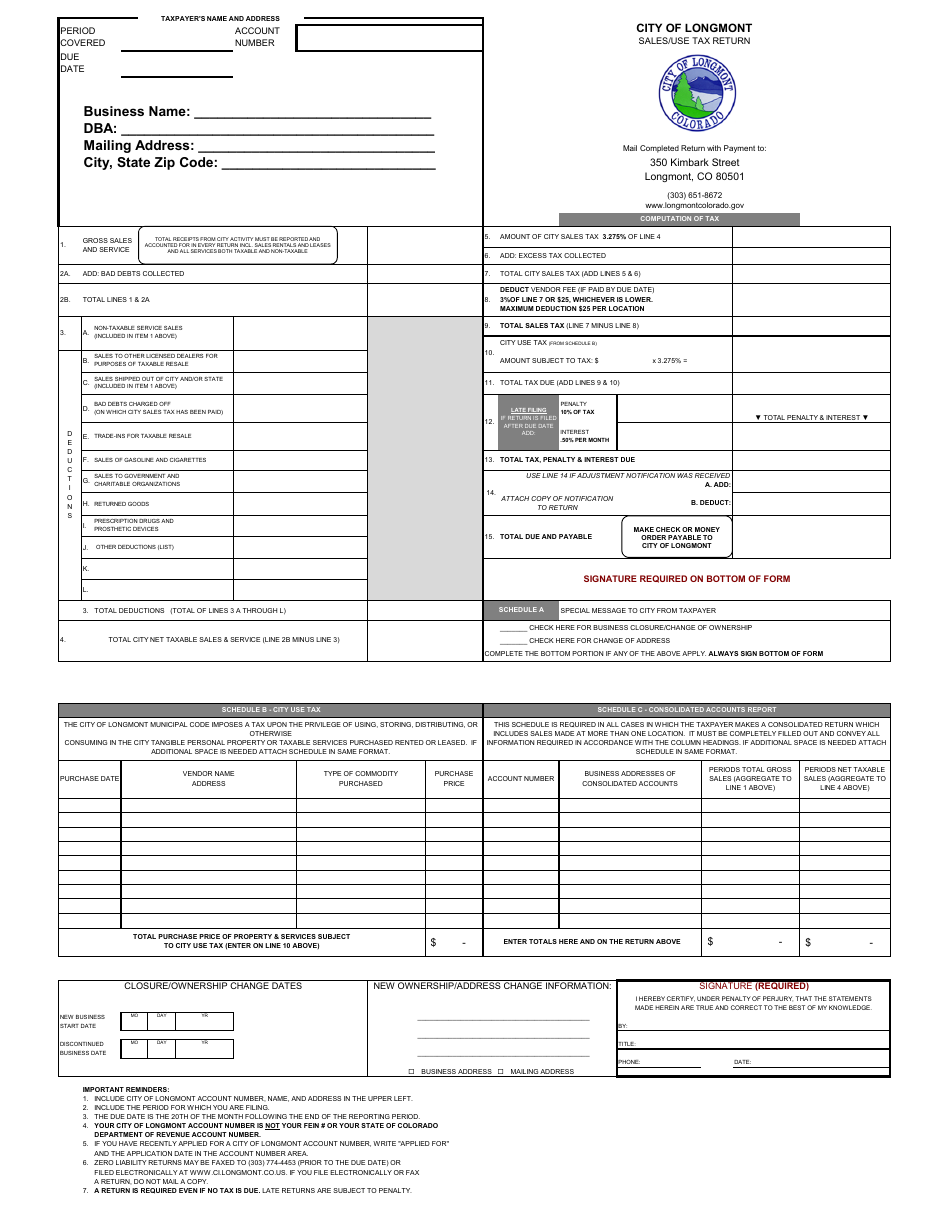

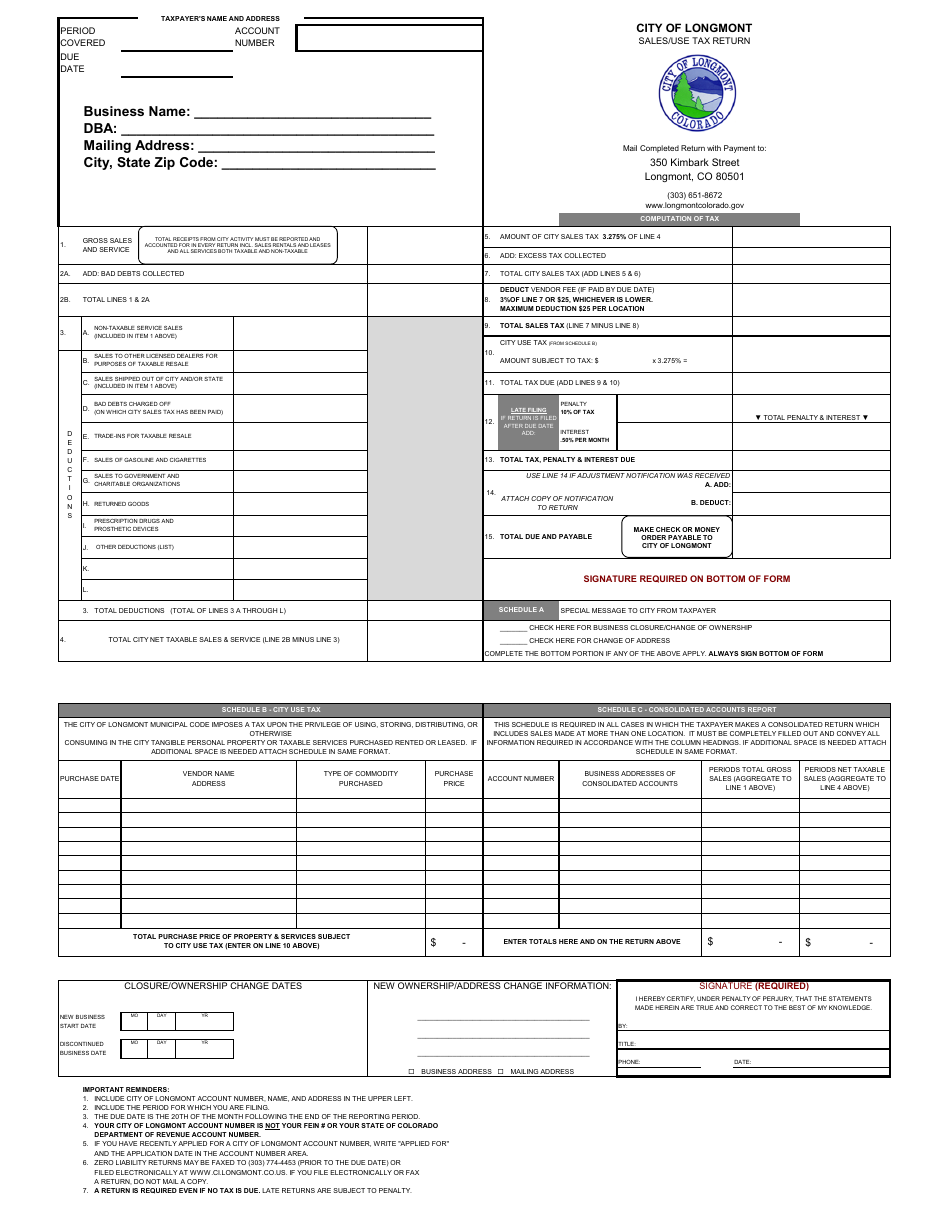

City Of Longmont Colorado Sales Use Tax Return Form Download Printable Pdf Templateroller

Business Licensing Tax City Of Lakewood

Will Ohio S Tax Filing Deadline Be Postponed To May 17 To Match The New Irs Deadline Cleveland Com

File Sales Tax Online Department Of Revenue Taxation

Business Licensing Tax City Of Lakewood

Pin By Experto Tax Service On Experto Tax Service Small Business Online Small Business Online Business

We Make You A Fake Tax Return Document For 2017 Or Earlier Year Great Proof Of Annual Income For Application Purp Tax Return Income Tax Return Irs Tax Forms

City Of Lakewood Income Tax Fill Online Printable Fillable Blank Pdffiller

Business Licensing Tax City Of Lakewood

File Sales Tax Online Department Of Revenue Taxation

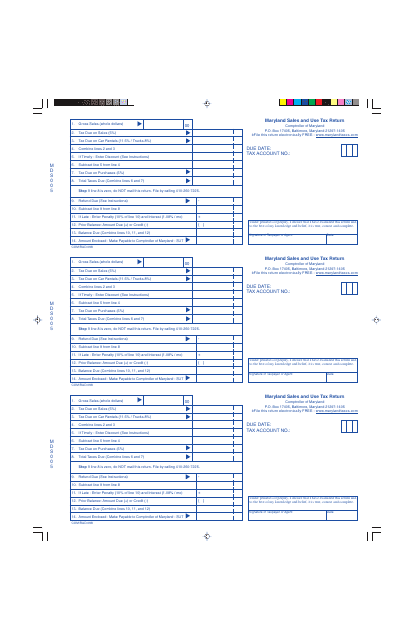

Maryland Sales And Use Tax Return Download Printable Pdf Templateroller

City Of Lakewood Colorado Sales And Use Tax Return Form Download Fillable Pdf Templateroller